Markets Do a Victory Lap - 3rd Quarter 2024

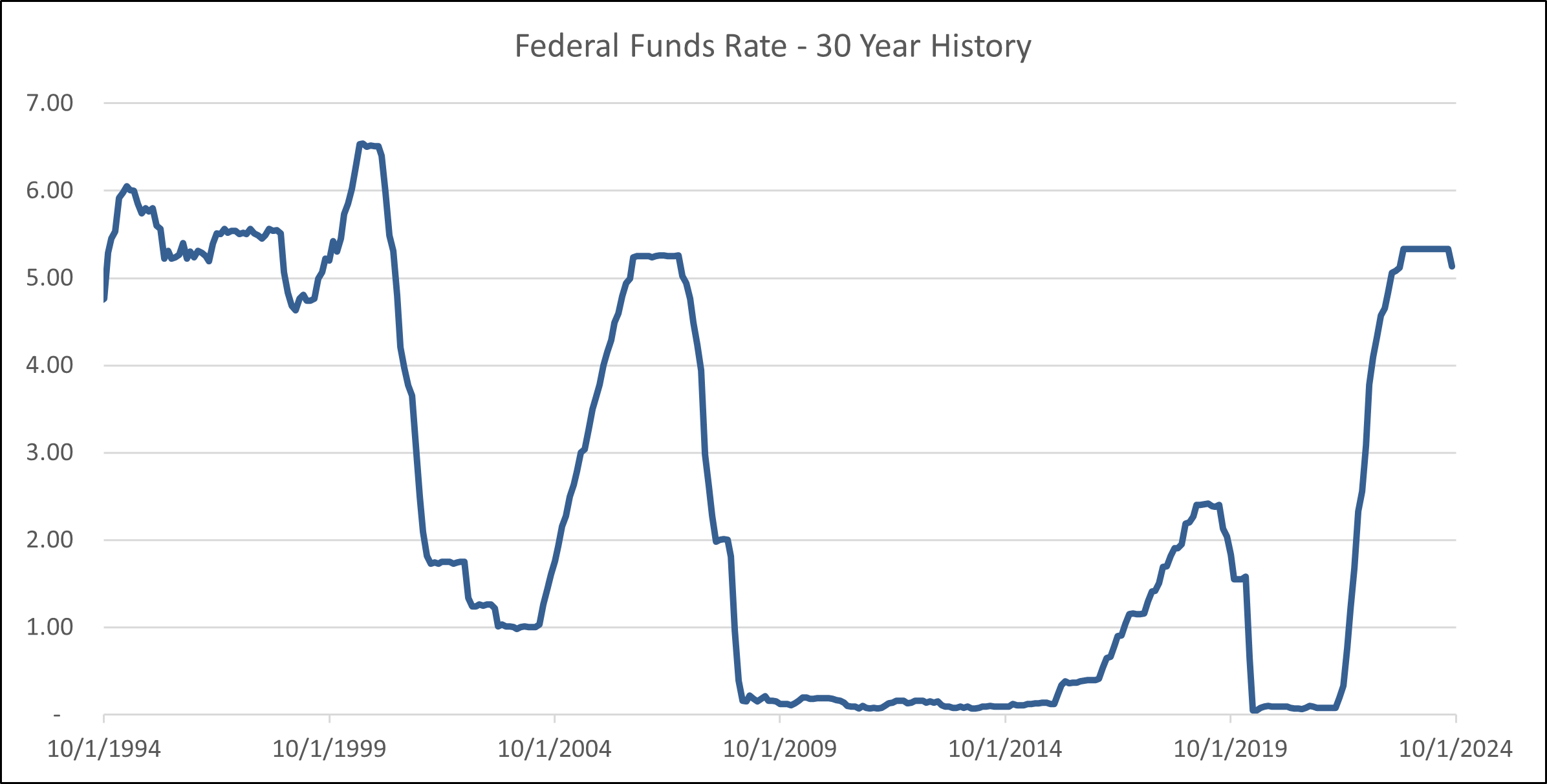

Markets rallied during the quarter as the much discussed, and fretted over, ‘soft landing’ (a decline in inflation without an economic recession) came further into focus. Global equities rose an improbable 6.7% which importantly included segments beyond large cap tech. Perhaps even more remarkable was the 5.2% return from U.S. investment-grade fixed income. Inflation, the labor market, and economic growth, all cooled at a desirable pace, causing the Federal Reserve to finally cut interest rates for the first time since 2020. In the weeks leading up to the Fed meeting in September, markets anticipated a rate reduction of 0.25%. Subsequent data released shortly before the meeting, however, pushed a larger cut of 0.50%. Various headline risk still remains. Wars in three different continents, trade tensions with China, and the impending U.S. presidential election are all capable of reigniting downward volatility. For the time being, markets are celebrating the perceived ‘soft landing’ win with a victory lap.

Up until very recently, most market participants have, understandably, been highly skeptical of the Fed. The Fed did, in hindsight, play an unfortunate role in exacerbating global inflation with an excessive policy response to COVID. Surprisingly, history has shown that achieving a ‘soft landing’ at the end of a rate hike cycle is not only possible, but somewhat common. Looking back the last 50 years, over nine different economies, and a total of 48 monetary policy cycles, a ‘soft landing’ was achieved about one third of the time. Sudden supply shocks, such as the case with oil in the 1970s, was among the most common aspects of failed cycles, leading to higher prices and lower economic growth. Solving the demand side of the equation with policy adjustments has proven to be significantly easier.

Source: Bloomberg LP

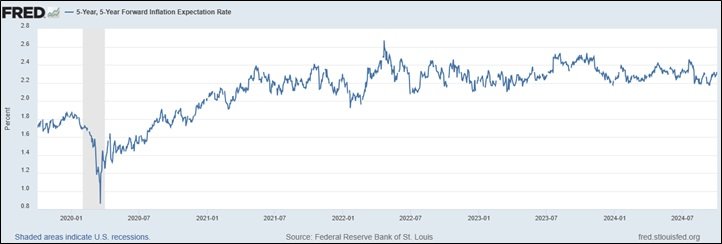

Successful cycles have had a handful of characteristics in common, including a resilient stock market, an only moderate rise in unemployment, and a favorable long-term view of inflation expectations. At the time of this writing, the stock market in the U.S. is very strong. While the labor market has softened and the unemployment rate has ticked higher in recent months, the unemployment rate remains near historic lows, real wages are rising, and the consumer savings rate is strong enough to support continued spending. The picture surrounding long-term inflation expectations also appears positive, with markets pricing in a continued decline in the rate of inflation over the next five years to the range of 2.0-2.5%. All these factors are, of course, subject to change and may develop quickly.

As we enter the final quarter of the year, the current and forecasted conditions should support valuations. The most significant factor influencing returns could be the Fed’s supportive comments over the direction of short-term rates. As mentioned previously, wars, trade tensions, and elections are all capable of reigniting downward volatility, but we feel these will be short-term in nature. China recently announced new stimulative measures to bolster domestic growth. Though analysts are divided on how effective this will be, all things equal, it is a net positive for global economic demand. For this reason, barring a new flare up with China, we believe the escalating conflict between Israel and Iran is the bigger threat to financial markets today. We are wishing for peace in the region and the rest of the world.

Thank you for reading and please reach out to continue the conversation.

EPIQ Partners